Goals Update

I read the other day that 25% of people give up on their New Year’s resolutions by the end of the first week and about 43% give up by the end of January. Not following through was the main reason I decided not to set resolutions, but rather set some goals that I could check in on throughout the year or change/adapt as necessary.

As a reminder (I won’t write this every post but just to summarize here in this update) my goals were as follows:

- Eat out less

- Reduce spending by 20%

- Eat fewer ultra high processed foods (UHPF)

- Run certain races

- Get 75 – 150 minutes of cardio and 2 days of weight training in

- Reduce alcohol intake

We have been out to eat only twice since 1/1 ( record for us), the 20% reduction is still in progress, looking good on eating fewer UHPF, exercise is a little slower than I wanted but I’ve cut alcohol intake significantly compared to the past year. Despite all of that weight loss is slow. I guess as we age, particularly women, losing weight is really a combination of a significant cutback in calories in and a fairly significant increase in calories out, through exercise. Though exercise has been slow to start in this new year, I did get out for a hilly 30 minute walk yesterday and it was delightful.

One goal that came up after I wrote my first post this year, is to figure out whether I have enough passive income to cover my estimated expenses. I sat down and did a deep dive and figured out that I have enough passive income to cover about 75% of said expenses. You’re probably interested in those exact numbers but, really, they aren’t relevant to you. The key is to closely track your expenses so that you know how much YOUR expenses are and then track your passive income to see where you stand.

What my finding reveals is that I need to figure out a way to increase my passive income by about 25% in the coming year, OR I could reduce my expenses. I have never been a “budget” type of person unfortunately. I figure out how much I want to save and put that away, then whatever is left I have available to spend. It has always worked for me but I’m sure is not the right approach for everyone.

As I go through the year, I’ll be monitoring, on a monthly basis, my accounts to see if I am on track to get that extra 25% in before I fully stop working, whenever that might be. BUT, one point I should add is that even if I, or you, aren’t able to reach that magic 100% of expenses covered by passive income, keep in mind that there is always the possibility to supplement passive income with some active, earned income.

For example, (this is an EXAMPLE, not my situation) if someone needs $20,000 in passive income to cover annual expenses, but only reaches a total of $17,000, that person would need to do some work to fill in the extra $3000. Many early retirees do that these days by taking work that is flexible in days and time, such as personal grocery shopping or Uber food delivery or driving. There are many other side hustles that retirees can do to supplement their income – taking surveys, participating in research studies at local universities, or if getting out of the house is a preference, working at local stores might be a possibility. The point is that despite the ageism in America (yes it’s real – I have many stories of friends and family being affected by this) there is a lot of work out there. Though it may not be as lucrative as we had when working in a full time career, it might be just enough so that we don’t have to worry about our finances.

Travel is a passion for me, and that is an area where I will continue focus my funds in the future. I love the Denver International Airport and look at that searingly blue Colorado sky. Though the construction now makes it a pain transiting through there, it’s stunning design always catches my eye.

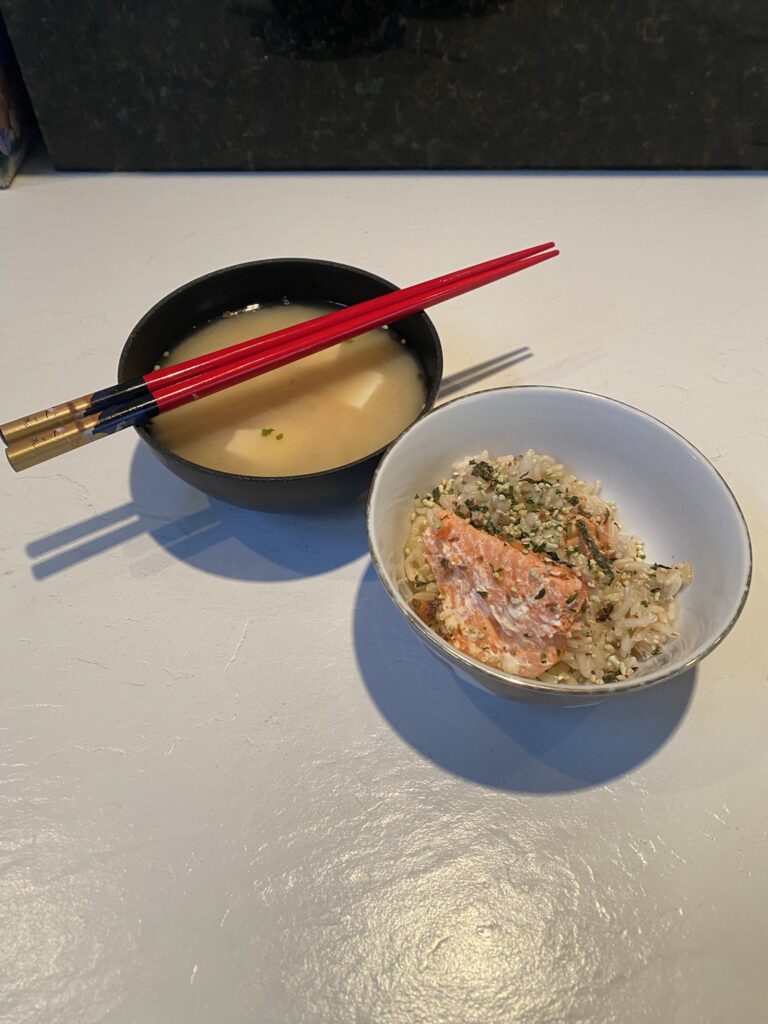

And, finally a picture of my delicious and simple Japanese breakfast – miso soup with tofu, grilled salmon and brown rice. The perfect start to my Sunday.